SCS

0.2300

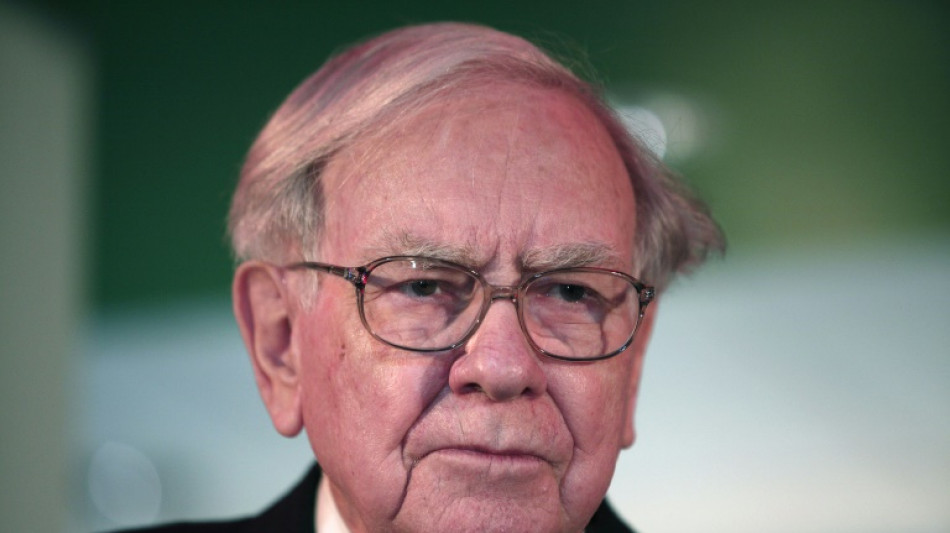

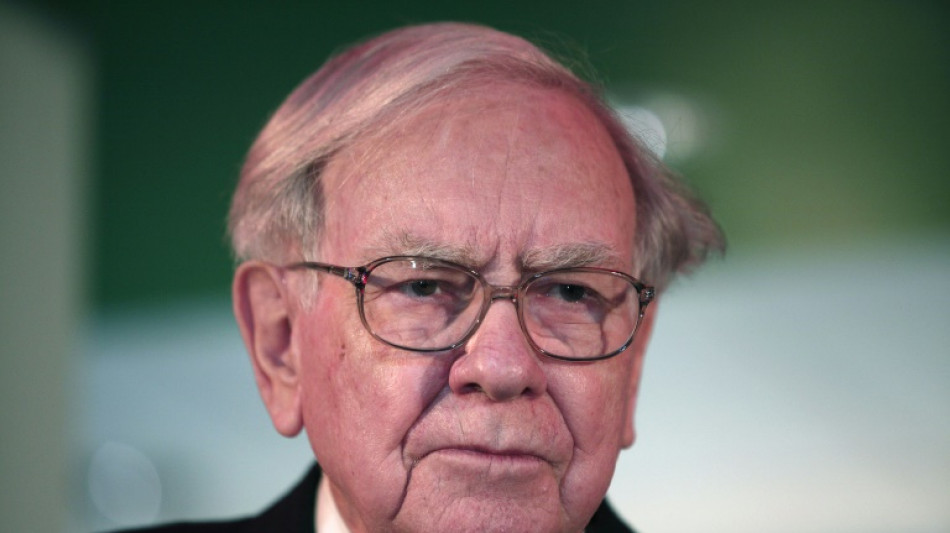

Shares in Chinese electric carmaker BYD plunged on Wednesday after its largest backer, Warren Buffett's Berkshire Hathaway, reduced its stake amid speculation of a potential exit.

Hong Kong-listed shares of the EV manufacturer fell by as much as 13 percent, a day after a regulatory filing showed Berkshire reducing its holdings from 20.04 percent to 19.92 percent.

It ended the day 7.9 percent lower, while its Shenzhen-listed stock finished 7.4 percent down.

The sale of around 1.33 million securities was valued at approximately $47 million.

Electronic carmakers in China were left scrambling after the government response to coronavirus outbreaks this year disrupted supply chains, with plants across the country suspending production for weeks.

While the Shenzhen-based firm reported strong earnings this week, rumours have swelled that the legendary American investor behind Berkshire may be looking to offload his entire stake.

Berkshire first bought 225 million BYD shares in 2008 and has been the biggest stakeholder in the company, now China's largest EV manufacturer and a major rival to Tesla.

Berkshire sold around 6.3 million shares in BYD between June 30 and August 24, Bloomberg News reported, citing filings from both companies.

BYD told Chinese media that there was "no need to over-interpret" the stake sale, adding that the company was operating normally and had no major moves to disclose.

On Monday, the Shenzhen-based company reported that net income had tripled to 3.6 billion yuan ($521 million) from a year earlier, overcoming supply chain disruptions caused by the pandemic and China's economic slowdown.

BYD said in a filing that it achieved record output and sales in the first half, with revenue jumping 66 percent year-on-year to 151 billion yuan.

The carmaker added that it was leading the domestic new energy vehicle sector with 24.7 percent market share in the first six months, citing data from the China Automobile Association.

"Investors could interpret this as the beginning of Berkshire closing its position in BYD," Bridget McCarthy, a market research analyst at hedge fund Snow Bull Capital, told Bloomberg.

"I would expect arguably one of the world's greatest investors to take some profits after over a decade, especially on his highest-returning investment, percentage-wise."

Some analysts have argued that BYD's strong fundamentals, coupled with Beijing's push to develop its domestic green energy sector, means the company still has room to grow.

"Despite the short term share price struggle, there is value to invest in the company with its solid business model in the medium to long term," Andy Wong, fund manager at LW Asset Management Advisors in Hong Kong, said.

Last month, a stake identical to the size of Berkshire's holdings was entered into Hong Kong's Central Clearing and Settlement System.

Hong Kong requires anyone who owns more than five percent of a listed company to notify the stock exchange when initiating a trade that changes the stake percentage into the next whole number.

P.E.Steiner--NZN